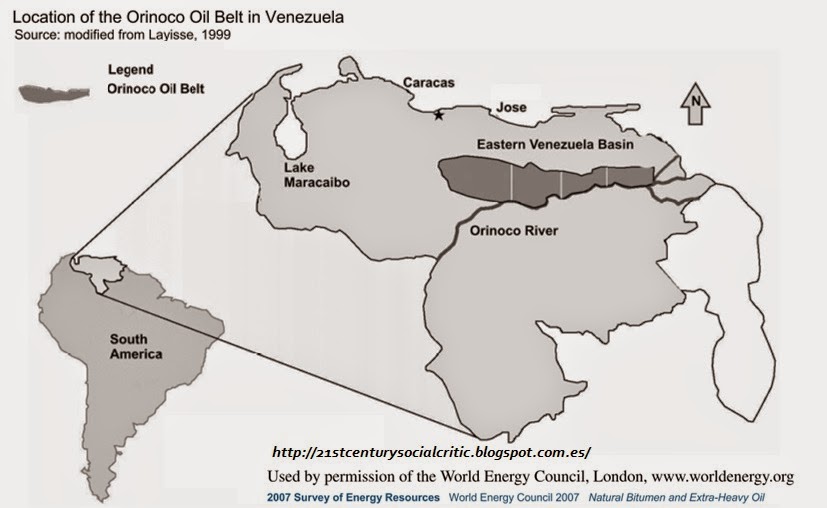

The following documents oil reserve estimates for extra heavy (heavier than 9 degrees API) and conventional (9 degrees API or lighter) for Venezuela. The dividing line was set at 9 degrees API to separate the Orinoco Oil Belt (Faja del Orinoco) from the rest of the country.

The Orinoco or Faja is a giant stratigraphic trap, which holds approximately 1.3 trillion (10 to the 12th power) barrels. Most of the oil to be produced ranges between 7 and 8 degrees API, but there are outliers.

Orinoco Heavy Oil Belt (or Faja del Orinoco) location map

Commercial production in the Faja began in 1992, from the "Bitumenes del Orinoco" block. This production was gradually expanded as markets were secured for the crude, which was sold as an emulsion (Orimulsión) of oil in water, which was burned in power plants in Japan, Canada, Italy, and Denmark. In the late 1990´s and early 2000´s production started from an additional four blocks, developed by consortia led by foreign oil companies (associated with PDVSA). The four blocks were connected to four upgraders located near Jose. These upgraders made syncrudes (or synbits) ranging between 18 and 34 degrees API.

The Bitumenes del Orinoco block was ceded by PDVSA to a Chinese company, which suspended the emulsion sales and proceeded to sell diluted crude (identical to Canadian dilbit made with naphta).

The Chavista regime in power in Venezuela decided to change contract terms for the extra heavy oil operations in 2006, and this has deteriorated their performance. Although PDVSA has been focused on drilling in the Faja, the lack of infrastructure limits the ability to market and produce this oil. I believe production from the developed areas is about 680 thousand barrels per day of extra heavy crude. However, this crude has to be blended with naphta and/or light crudes, therefore the volumes being pumped from the field areas are higher.

I used personal knowledge and published data about the heavy oil projects and the Faja reservoirs to estimate how they would be developed and perform under four scenarios. The same approach was used to estimate production from the conventional oil reservoirs.

The $120 and $160 price scenarios assume the developments use modified Steam Assisted Gravity Drainage (SAGD), cyclic steam, or other enhanced oil recovery methods. This pushes the recovery factor for some developed areas beyond 30 %. However, even in the high price scenario cases I have assumed some of the oil sands wouldn´t be developed, because they are too thin, too close to the main aquifer, or have other drawbacks.

Although Venezuela has significant natural gas reserves, it´s running short at this time. To fill the gap it has been importing gas from Colombia, but this measure is insufficient, and at this time they are shutting down some of the iron and aluminum production to preserve gas supplies to the consumer sector.

If Venezuela were to proceed with full development to the high rates and recoveries assumed in the high case, the energy needs for these projects may require the use of nuclear power plants. There are other alternatives, but I mentioned the nuclear plant option to allow the reader to understand that the high case does require radical measures, and demands huge inputs.

The resulting reserves for the four scenarios are shown in this table:

Venezuela´s future reserves (as of Jan 2015) for four scenarios

The production forecasts for the four price scenarios follow. The price is assumed to hit that value in 2016, and remain constant in 2014 dollars forever.

Production forecast for the $80 per barrel

(2014 dollars) price scenario

Production forecast for the $120 per barrel

(2014 dollars) price scenario

Production forecast for the $160 per barrel

(2014 dollars) price scenario

A omparison of the total production for the price scenarios I used is shown below. These are compared with the recently published EIA 2015 Outlook forecast. I have some concerns over EIA curve´s accuracy (I had a forecast for Venezuela and Ecuador, so I had to take Ecuador out, and I´m not sure I landed the Venezuela numbers exactly as predicted by the EIA, but it looks close enough).

Forecast comparisons

This is the oil production rate versus cumulative conventional oil produced. The forecast uses the $120 per barrel oil price scenario.

The production drop to the minimum at around 40 was caused in part by OPEC quota reductions in the first half of the 1980´s, a strategy which failed when the oil price began to crash late 85. The peak at the 50sh mark is is caused by two factors: the oil price began to recover, and the discovery of the deep Furrial trend in Eastern Venezuela.

The steep drop after that second peak at 1.2 is due to: 1. Heavy oil projects start coming on and eat some of the conventional oil OPEC quota and 2. Chavez became president and oil production starts dropping due to underinvestment and labor strikes.

The subsequent recovery was to the subdued peak at 70 is the result of the "regime change" and higher price environment which the scenario assumes begins to impact the decline rate by 2017.

Conventional Rate versus Cumulative Oil Produced

No hay comentarios:

Publicar un comentario